The Black Becky Bloomwood

how my favorite fictional character inspired me to start paying off my credit card debt with the help of my closet and develop a surprising amount of self-compassion along the way

“OK don't panic.”

Books 1-6 in Sophie Kinsella’s brilliant Shopaholic series all start with those three words except for the one that begins with,

OK. I can do this, no problem.

Some of Sophie Kinsella’s stand-alone novels start in a similar tone. The first line of My Not So Perfect Life reads,

“First: It could be worse.”

If you string those phrases together, your mantra might become,

“OK don’t panic. I can do this, no problem. It could be worse.”

Pretty good reminder for someone who finds themselves in a tricky predicament.

And God knows, Becky Bloomwood (protagonist of the Shopaholic series) has been in plenty of those.

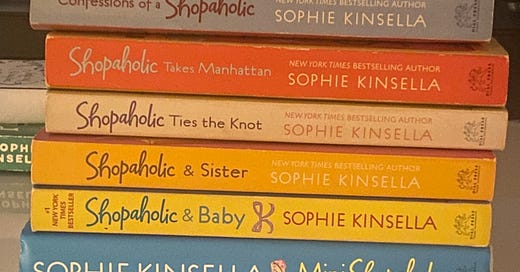

I don’t remember how or when I came across Sophie Kinsella’s Shopaholic series; I just remember being hooked. I read them all sometime between high school and college before moving on to Sophie Kinsella’s other solo novels. My Not So Perfect Life even came out the summer after I finished college – very serendipitous timing

Throughout the Shopaholic series, I came along as Becky fell in love, got married, bonded with a long-lost sister, had a baby, navigated motherhood, and more. She travels to New York, LA, Las Vegas, and even all around the globe on a yearlong honeymoon that I’ve been envious of since I read about it.

But before all that, here’s what I learned about Becky from the first few pages of Confessions of a Shopaholic —

She’s tenacious

She’s hilarious

She loves a good sale

She can justify just about any purchase

Here are a few ways that Becky and I differ –

She’s from England. I’m from across the pond in New York.

She starts the book with a stable income. I’m currently a freelancer and entrepreneur.

She *really* struggles with not shopping. I’m always ready to shop, but not quite to the same extent

Here are similarities that Becky and I now share, many years after I first started the beloved series —

We’re both writers

We both love shopping and luxury

We both share the same strong determination and willpower. In short, we’re creative problem solvers who don’t give up.

Oh – and one more important similarity –

We’re both facing sizable credit card debt.

I can’t pinpoint exactly one purchase or bill that got me into credit card debt. It’s really not that simple. Nothing is.

I could tell you that I lived beyond my means, but that’s technically always been a little bit true.

I’ve relied on my savings between different jobs for years. I’ve also received varying levels of support from my family since I graduated college and entered the adult world.

I could tell you that I made reckless financial decisions, but I don’t believe that.

I don’t think it was reckless to start a business I believe in.

I don’t think it was reckless to take trips to celebrate my friends (from weddings to graduations to plays

I don’t think it was reckless to move across the country to find peace after an unimaginable season of grief. I don’t think it was reckless to move back after the U.S. election results changed my sense of community + my worldview and sense of safety overnight. As I always say, if the world is ending, I’ve gotta be in New York.

*to be clear, I am very aware that the world is not literally ending. However, things are bleak, life as we know it in the U.S. has changed for the worse, and vulnerable communities are in intense danger — to put it lightly. I spent the first 5 days after the election watching The Handmaid’s Tale, eating Costco rolls, and crying.

I could walk you through every single twist and turn that led to this precarious, vulnerable new financial reality I find myself in, where my savings are virtually gone and the flow of money is scarce. But I’m not going to do that either.

I’m learning how to talk about what’s going on in my life without feeling obligated to share every last detail. It’s been unnerving yet freeing.

I have always done the best I could with the tools I’ve had, at every point of my life. And I’m always trying to do better.

I’m not necessarily proud of the position I’ve found myself in, but I’m also no longer ashamed.

I also know I’m not alone.

At the start of the series, Becky owes around 1,000 pounds to her credit card company. I probably thought that was a pretty large number when I first read the book in my teens.

In the 2009 movie adaptation, based on the first two books, Becky faces a similar dilemma with a much bigger price tag; $17,262, a number eerily close to my current credit card statement.

Becky and I landed debt in quite different ways. My closet is not responsible for my debt. My closet did not land me in this predicament.

Yet like Becky, my closet just might get me out of it.

In the books, Rebecca gets out of debt by landing an unexpected new job, ironically, giving really good and relatable financial advice.

But in the movies, she sells a lot of clothes.

While I am definitely looking for more work right now, I’m going with the movie solution in the meantime.

I’ve listed 50+ items and counting on Facebook marketplace and Mercari.

I’m thinking about expanding to eBay. Friends who have sold unwanted items online before tell me that I’ve had an incredible amount of traffic so far, even though I’m still impatient to make more sales.

The clothes, kitchenware, and furniture I’ve listed are a collection of things that no longer fit either my body or my life.

There are also a select few items that I’d love to keep – and plan to purchase again one day when I’m in a better financial position. It’s hard to justify keeping a dress that costs $500+ you’ve only worn once when you’re battling mounting credit card interest.

I’ll remind you again that my closet did land me in this situation. But yes, like Becky Bloomwood I do thankfully have some nice things to sell.

(To be clear, there’s nothing wrong with being a self-proclaimed shopaholic —I’ve been there. It’s just not an accurate description of who I currently am.)

I’m someone who started a business and expected it to bring in more revenue. 2024 included some of my biggest wins and most colossal setbacks. It was a year in which my wins didn’t equate to the financial prosperity or security I’d hoped for.

I’m someone who didn’t think her savings would disappear so quickly. I can’t quite describe what it’s like not to have the personal emergency fund I’ve previously had, and to feel so financially vulnerable.

And through it all…

I’ve decided that I am more than my credit card balance, savings account, and credit score.

I’ve decided that I am not “bad with money”.

And most of all, I’ve decided to no longer allow myself, or anyone else to shame, scorn, or look down on me.

My conversation with Melissa Mitt taught me SO much about how to have an authentic relationship with money. A lot of her wisdom and insights have helped me find compassion for myself throughout this journey.

But of course, letting go of shame does not happen all at once, and it is also not synonymous with caring what people think. And I, of course, care what people who I love and trust think of me.

And, I’m also curious about what strangers on the internet will think of me. Or even people in my life, who may read this with raised eyebrows, confusion, and judgment.

I sometimes get caught in a swirl of thoughts like “What if people think you’re irresponsible?” and “What if this changes how people see you?” But ultimately, I know that someone who meets me with judgment instead of compassion has no place in my life anyway.

I’m not looking for friends who throw stones from their sheet-thin glass houses. I’m looking for friends who will sit with me on the living room floor, take a look at the space once occupied by my coffee table* and peloton, and raise a toast.

When I first drafted this piece, the coffee table had not sold yet, and a day after I wrote it, THE TABLE SOLD! It was a huge moment. So huge that I wrote about it. Here’s hoping for some similar magic in the days and weeks to come. Selling pajamas and scarves and dresses is great, but moving some of the bigger ticket items I’ve listed would be major right now. If you know someone in New York who wants a peloton, send ‘em my way.

An Ode to Sammy Rae and the Friends & The Girl Who Just Bought My Coffee Table

I am in my own lane I will not let myself down

I’m looking for friends who know that being in credit card debt does not make you irresponsible, or bad.

Friends who know that asking for help does not make you irresponsible or bad.

Friends who know that wanting financial security again does not make me, or anyone, bad.

The most revelatory moment from my conversations with Melissa was when she reminded me that mortgage/home loans are literally debt too. I exclaimed, “Oh my god Mortgages are just fancy people debt!!” And last I checked, people aren’t thought of as irresponsible or bad for having mortgages. In fact, they’re celebrated.

How is a millionaire asking a bank for a loan to buy a house, different from a non-millionaire asking her community for help to climb out of debt?

So, this is the part where I ask my community for help!

I’ll start with the free things you can do —

Share this post!

Share the link to my virtual closet with any friends looking for fun new items to spruce up their wardrobe (or some great kitchenware, a peloton, a more. Especially ready to give my peloton a new home).

Share any remote job opportunities open to people in the U.S. — I’m actively applying to new roles to help supplement my income while I continue to write and build my coaching business.

Some other things I would deeply appreciate —

Every single paid subscription goes such a long way.

Thank you for reading. And thank you to Sophie Kinsella, for sharing your beautiful words with us. I

I would be remiss not to mention Sophie’s current cancer journey; she is living with glioblastoma, an extremely aggressive brain cancer. It is incurable, and yet Sophie says she has lived longer than many. Her recent novel is her most autobiographical book to date. It tells the story of “a renowned novelist with five children, facing a devastating diagnosis and learning to live and love anew”.

I cried when I heard about Sophie’s diagnosis, and have been keeping her and her family in my thoughts ever since. I don’t have the words to describe how much I admire her strength.